Jersey is a secure, well-regulated place to run digital commerce with direct access to the global card schemes and modern payment technology that supports online trading.

Even so, finding the right payment processor in Jersey can be more complex than it looks. Many UK providers don’t fully extend their services to Jersey businesses, or they treat Jersey differently. This can lead to higher costs, fewer features, slower settlements, or integration issues with the platforms you use. Where a global SaaS platform limits the payment providers available to Jersey merchants, this is often down to platform or provider setup, not a limitation in Jersey’s payments infrastructure.

Jersey businesses can still access established local and international payment service providers offering secure, compliant and scalable solutions. The key is selecting the right payment partner for your business model and doing proper due diligence when comparing service levels and transaction/volume-related fees.

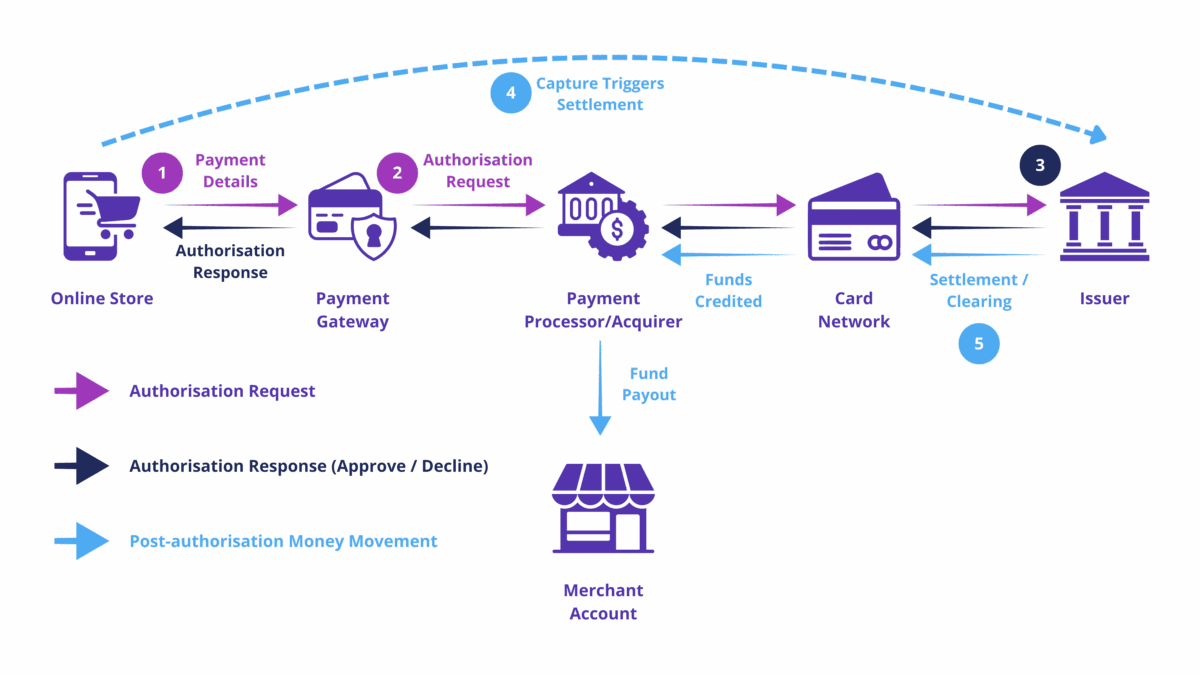

How Online Payment's Work

Key Considerations When Choosing Payment Gateways and Processors in Jersey

Choosing a payment gateway and processing partner isn’t just about headline rates or the look of a checkout page. It’s about making sure your business has the right foundations in place.

Regional Connectivity

Confirm that the provider explicitly supports Jersey or the wider Channel Islands. Some list the UK but exclude Jersey, which can lead to rejected applications or missing features.

Fees and Pricing Structures

Compare per-transaction charges, monthly costs, and any setup fees. Smaller businesses should be especially aware of volume-based pricing that penalises low turnover.

Security & PCI Compliance

Make sure the provider is fully PCI DSS compliant and offers strong fraud-prevention tools to protect your business and your customers.

Regulatory Compliance

The provider should meet Jersey Financial Services Commission (JFSC) requirements for anti-money laundering (AML) and countering the financing of terrorism (CFT). That includes proper onboarding checks and ongoing monitoring.

Integration Capabilities

Your payment partner should work seamlessly with your systems — whether that’s an in-store EPOS terminal or an e-commerce platform. Strong API support and a clear technology roadmap will add long-term value.

Customer Support

Payments are business-critical. Choose providers that offer responsive, knowledgeable support — ideally with local contact points or dedicated account managers.

FAQ's

*Digital Jersey does not endorse or recommend any provider listed below. The table is for general information only and may not be complete or up to date. Please carry out your own due diligence and fact-check key details (e.g. fees, eligibility, availability) before making any decisions. Digital Jersey accepts no responsibility or liability for actions taken based on this information and recommends seeking independent professional advice where appropriate. Regulatory registrations and PCI status should be confirmed with the provider.

Payment services available to Jersey businesses

| Provider | Category | Jersey Support | Settlement Speed | Payment Methods | Integration Options | Fraud / Risk Tools |

|---|---|---|---|---|---|---|

| Adfin | Gateway + Open Banking | ✅ Yes | Not stated online | Cards (Visa/MC/Amex), wallets (Apple Pay/Google Pay); bank transfer; pay by bank (Open Banking) | Hosted checkout; API; plugins (Xero/QuickBooks) | Not stated online |

| Adyen | Processor + Gateway | ✅ Enterprise only | Sales day payouts with typical 2 business-day delay before funds are paid out; bank clearing can add time (working days). | Major cards + Apple Pay/Google Pay; many local methods (e.g., iDEAL, Klarna) depending on your account/region. | Shopify (Plus/Enterprise) app; Web Drop-in/Components/API; Pay by Link; Terminal API for POS. | RevenueProtect risk engine incl. dynamic 3DS2, risk rules & case management. |

| Antom | Processor / Gateway | ✅ Enterprise only | Not stated online | Cards (Visa/MC/Amex), wallets (Apple Pay/Google Pay); multiple APMs | Hosted checkout; API | Not stated online |

| Braintree (PayPal) | Gateway + Processor | ✅ Yes (via PayPal) | Typically 1–3 business days for Visa/Mastercard; up to 7 days for Amex/others. | Major cards (Visa, Mastercard, Amex, Diners), PayPal, Apple Pay, Google Pay; recurring billing supported. | SDKs & APIs for web and mobile; plugins for WooCommerce, Magento, BigCommerce; vault & tokenization features. | Advanced Fraud Tools; 3D Secure 2; PayPal Seller Protection (eligibility applies). |

| CheckOut (Jersey) | EPOS + payments integrator Processing/acquiring is provided by an underlying provider (and CheckOut connects you to it). | ✅ Yes | Varies by the underlying acquirer/solution provided (not published). | Varies by solution (EPOS, kiosk, online); typically supports contactless/card and wallet acceptance. | On-island integration services for EPOS/kiosk and online; consult for platform compatibility. | Provided by the chosen gateway/acquirer (not a standalone risk platform). |

| CityPay | Local PSP (Acquirer / Gateway) | ✅ Yes | Next-day settlement (subject to standard risk review). | Visa, Mastercard, American Express, JCB & Discover (via gateway), and wallets including Apple Pay, Google Pay and Click to Pay. CityPay supports 3DS, Credential on File (CoF), tokenisation, e-commerce, MOTO, IVR, and card present trans. | Hosted Paylink, REST API/SDKs, JavaScript Elements integration, and support for platforms including Xero, QuickBooks, Shopwired, ResDiary, Magento, OpenCart, WooCommerce, as well as bespoke integrations. | 3-D Secure (3DS2), AVS/CV2 checks via gateway; risk controls configurable per account. |

| emerchantpay | Processor + Gateway | ✅ Yes | Typically T+2 to T+3 business days (depends on acquirer setup). | Major cards (Visa/MC/Amex), plus 100+ alternative payment methods globally (Klarna, Sofort, iDEAL, etc.). | Hosted Payment Page, Direct API, Mobile SDKs; plugins for Shopify, Magento, WooCommerce, PrestaShop. | Built-in risk management suite; PCI DSS Level 1; 3DS2 support; advanced fraud scoring. |

| Fondy | Processor + Gateway | ✅ Yes | Typically 3–5 working days; instant payouts available for eligible merchants/flows (depends on region and underwriting). | Major cards (Visa, Mastercard, Maestro) + Apple Pay / Google Pay; multiple local APMs (e.g., iDEAL, Bancontact, SOFORT, BLIK, EPS, Przelewy24); supports recurring billing. | Hosted checkout; embedded/iFrame checkout; REST API/SDKs; plugins for Shopify, WooCommerce, Magento, OpenCart, Wix; Pay by Link; tokenisation/vault. | PCI DSS compliant; 3-D Secure (3DS2/SCA); built-in risk checks; KYB/KYC; rules & monitoring; chargeback management. |

| IXOPAY | Orchestration Platform | ✅ Yes | N/A – handled by connected PSPs/acquirers (orchestration layer only). | Varies by connected providers (200+ connectors available). | Gateway & Management APIs; smart routing; 3DS connectors; marketplace/multi-acquirer setups. | Built-in risk engine, 3-D Secure support, rule-based routing & retries. |

| MangoPay | Modular Infrastructure (Marketplace PSP) | ✅ Yes | Wallet-based; bank payouts via SEPA/FPS. SEPA Instant & RTGS options available for EUR (same-day/seconds when supported). | Major cards + many APMs (Apple Pay/Google Pay, iDEAL, Bancontact, Klarna, PayPal, SEPA/BACS DD, etc.). | API-first with SDKs; wallet-led flows; payout APIs; hosted components. | Built-in KYC/KYB/AML services; 3DS2; fraud monitoring across user lifecycle. |

| Modern World Business Solutions | Reseller / PSP | ✅ Yes | Depends on acquiring bank used; typically 2–5 working days. | Cards (Visa/MC/Amex); can integrate alternative methods depending on acquirer. | Custom integration; works as ISO/reseller linking businesses with acquirers. | Basic fraud tools and 3DS via partner acquirers. |

| MoonPay Commerce | Crypto payments | ✅ Yes | Near-instant crypto settlement; fiat off-ramp depends on setup | Major crypto assets; Cards (Visa/MC/Amex), | Hosted checkout / API | KYC/KYB; AML/Transaction monitoring |

| Opayo (Elavon) | Gateway (via Acquirer) | ✅ Yes | Submitted for next-day settlement; actual funding time depends on acquirer (often ~3–5 working days). | Cards (Visa/MC/Amex, etc.), Apple Pay/Google Pay; some APMs via integrations; 3DS2. | Hosted Payment Page (HPP), Direct (server-to-server API), Pay by Link; plugins for WooCommerce/Magento/others. | 3-D Secure (3DS2), AVS/CV2; enhanced risk incl. ACI Red Shield via Elavon. |

| Payoneer | Gateway + Payouts | ✅ Enterprise only | Not stated online | Cards (Visa/MC/Amex), Bank Transfers | Hosted checkout; API/SDK; plugins (Shopify/WooCommerce) | Fraud screening; chargeback assistance |

| Paymentsense | Acquirer / ISO + Gateway | ✅ Enterprise only | Typically 3–5 business days | Cards (Visa/MC/Amex), wallets (Apple Pay/Google Pay) | Hosted checkout; API; plugins; recurring | 3-D Secure (3DS2), AVS/CV2 |

| PayPal | Gateway + Processor | ✅ Yes | Funds available in PayPal balance immediately; withdrawals to bank typically 1–3 (up to 3–5) working days; Instant Transfers available for a fee. | PayPal wallet; cards via Advanced Checkout; Apple Pay & Google Pay (eligibility applies); various APMs depending on region. | Checkout JS SDK / REST APIs; hosted buttons; PayPal Commerce Platform. | PayPal Fraud Protection (+ Advanced), Seller Protection (eligibility applies). |

| Salespie | Integrator / PSP | ✅ Yes | Depends on connected gateway/acquirer | Cards via Elavon/PayPal/NMI (per integration) | Plugins; Pay by Link; POS integrations | 3DS / risk via connected gateway |

| Shift4 | Acquirer + Gateway | ✅ Yes | Not stated online | Cards (Visa/Mastercard/Amex); Apple Pay & Google Pay; local methods depend on market | E-commerce gateway/APIs; online payments | 3D Secure 2; anti-fraud tools (AI/ML) |

| Worldpay | Acquirer + Gateway | ⚠️ Case by case | Varies by product and acquiring agreement; dynamic payout options; timelines differ by method. | Cards + local payment methods (varies by integration). | Access Worldpay APIs; Hosted Payment Pages; plugins (e.g., OpenCart, Magento). | eProtect/3DS; risk & reporting tools via dashboards; additional partner tools available. |

Conclusion

The above list is a starting point; verify fit, eligibility, fees, and compliance with the provider.

Careful consideration relating to user experience, user interface, customer journey, integration and reporting are essential, as some providers will excel on marketplaces, others will lead on mobile devices and other may be more aligned for corporate entities.

Need additional guidance?

If you’re still unsure, need to discuss your requirements in more detail, please do not hesitate to contact Digital Jersey’s FinTech Lead nathan.delahaye@digital.je

Nathan de la Haye

FinTech Lead