Popular

Business Funding, Support and Resources

Whether you’re looking to build connections in the tech community, or to source funding, investors and talent, we can get you in the right room, with the right people.

Whether you’re looking to build connections in the tech community, or to source funding, investors and talent, we can get you in the right room, with the right people.

Being an innovator and scaling a start-up takes commitment, patience, hard-work and in most cases, funding. Every entrepreneur knows it, finding the capital to fuel your scale-up is necessary but often overwhelming, becoming a full-time job in itself. That’s why we work closely with local partners to help you access and secure the right information and resources to grow your digital business.

With a culture of responsiveness and innovation, TISE’s presence in Jersey provides a straight forward and cost-effective route for businesses at various stages in their lifecycles and across a variety of industry sectors – including Technology, Media and Telecoms (TMT) – to access the international capital markets through a recognised stock exchange.

Today, there more than 3,000 securities with a total market value of more than £450 billion listed on TISE.

Find out more

TEKEX is a 500+ high calibre network, whose focal point is to connect innovation with private capital and expertise to create a unique business acceleration ecosystem for Channel Islands and beyond.

Find out more

SharesInside connects start-ups directly with investors around the world.

A leading platform enabling companies to build strong relationships with investors while showcasing their company to new potential investors. Available through a mobile app and website, investors can find new investment opportunities, research these companies and subscribe for real time alerts all for free.

Find out more

Cambridge Capital Group is the leading private Members’ club for investors and entrepreneurs interested in the UK technology sector. Their international hub is based in Jersey.

The club’s purpose is to seek out the best early/growth tech companies and provide a forum for members to meet and explore mutual opportunities. CCG’s focus is on hi-tech early stage companies from sectors such as Software, Internet, Specialist Engineering and Digital Health.

During the group’s expansion outside of the UK, it selected the Island based on its international outlook and connections in addition to the availability of expertise in funding and vibrant local investor community.

Find out more

Envestors is an FCA regulated corporate finance adviser in the UK that works closely with highly innovative and inspiring business people as both entrepreneurs and investors. The company has been enabling investors to stay close to high growth opportunities for over 10 years, and has been operating in Jersey as Envestors CI for six years.

A strong on-Island network of angel investors has been developed by Envestors, and the organisation has seen companies grow exponentially, with investors achieving remarkable returns.

Find out more

With its forward thinking approach and political and economic stability, Jersey has a long-standing reputation for attracting both successful companies and the people that run them to its beautiful shores.

We’re experts at connecting businesses with the policymakers, regulators and industry leaders that hold the keys to unlocking your digital dreams. Whether at formal networking events or directly, we fully harness the benefits of relationships with key decision-makers.

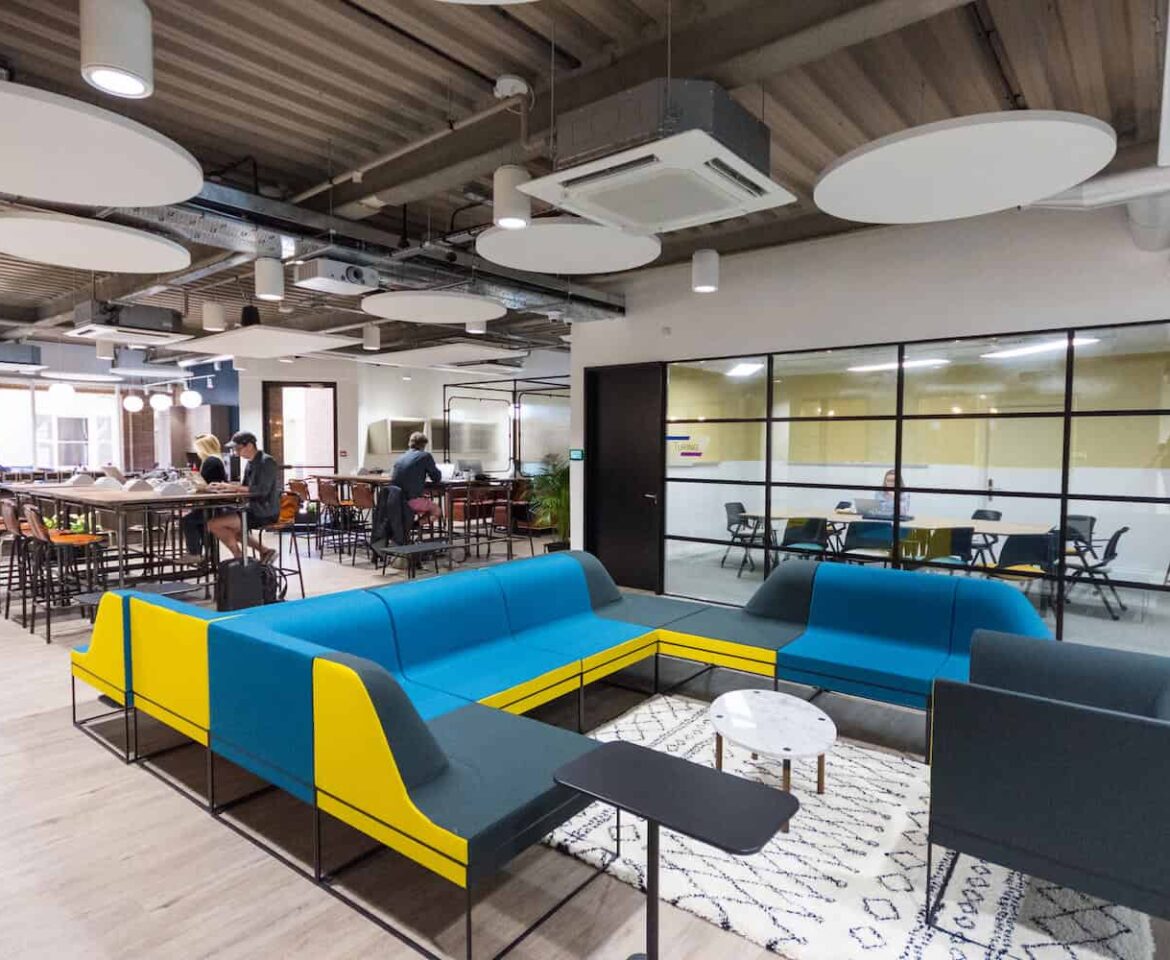

Digital Jersey offers local entrepreneurs, start-ups, enterprises and inward investors flexible, low-cost use of the Digital Jersey Hub as a platform from which to grow their business. Facilities include permanent workspace, meeting rooms, event space and access to hotdesking.

From advertisement of events on our website and social, to the opportunity to feature in our Newsletter which is distributed to 6000+ individuals, we go the extra mile to support the activity of our Members.

We have a strong working relationship with The Population Office and will guide and support businesses in seeking work permissions (Registered or Licenced positions) for employees. This includes assistance in compiling necessary documentation and applicant endorsement.