This is your roadmap guide to success on all your funding needs. Discover a wealth of funding options available to fuel your growth. We’ll explore stages of funding and your investment opportunities. Whether you’re seeking seed funding to kickstart your idea or scaling your business to new heights, this guide will equip you with the knowledge to navigate the funding landscape and achieve your entrepreneurial goals.

Key things to consider before starting your funding journey

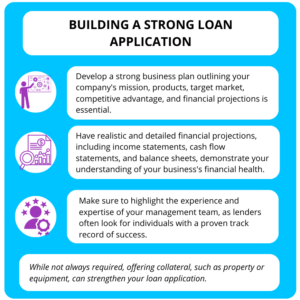

Write a rock solid business plan

Your first step to securing funding is to create a well-structured business plan that will draw investors in by showing them a clear roadmap to your success and demonstrating how viable your product is.

Identify what your funding needs are

Determine the specific amount of funding required and how it will be used to fuel your business’s growth.

Know your business valuation

Accurately assess your company’s worth by considering factors like revenue, growth rate, profitability, market size, competitive advantage and intellectual property to attract potential investors. Make sure to take the time to accurately assess your company’s worth to attract the right investors and build a successful startup.

Network and build relationships

Take proactive steps to connect with potential investors, mentors and industry experts by attending industry events, leveraging online platforms and reaching out to individuals directly to expand your network and gain a competitive edge.

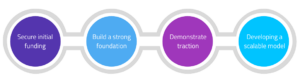

Securing Funding

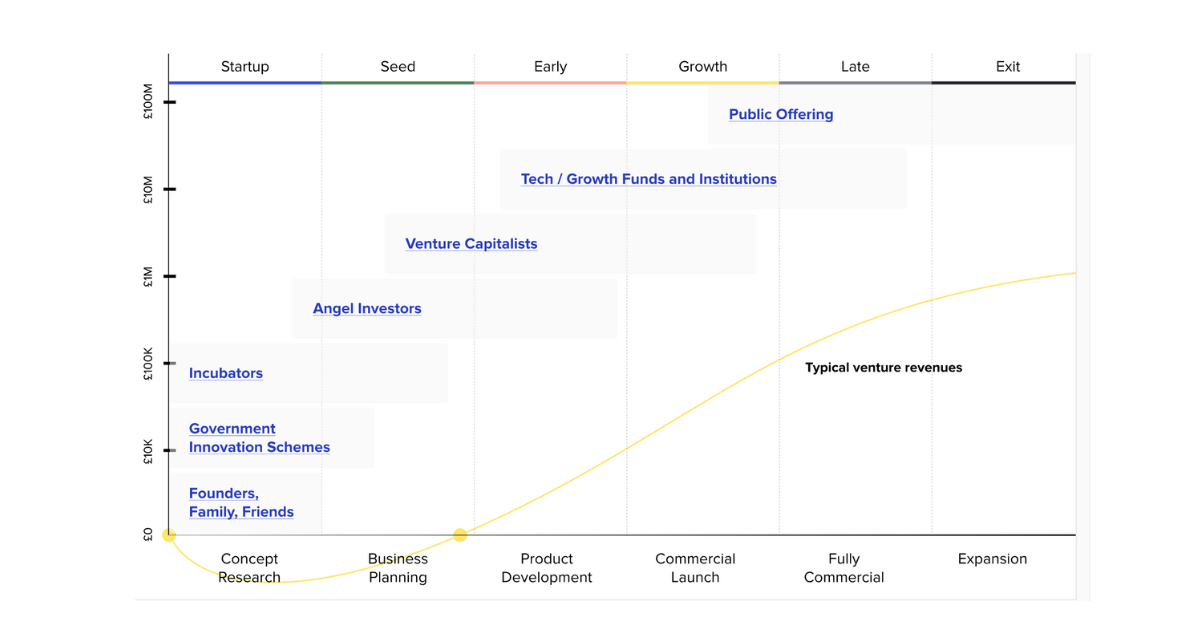

- Pre-seed stage is the early personal or small investments that help develop the idea

- Seed stage is when you gain initial funding from an early stage investor or angel investor to build the prototype or help with launching the product

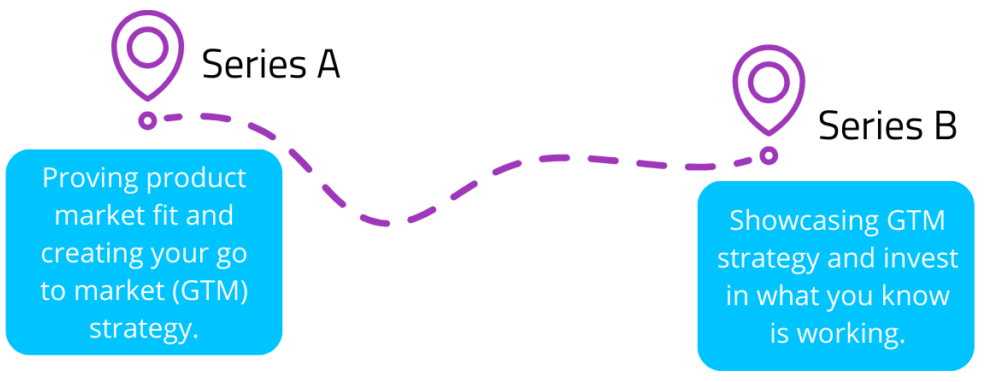

- Series A is when you secure funding in order to scale the product and grow the user base

- Series B is when it is time to improve the business model through funding, gain capital to expand market reach

- Later stage funding is where you can secure funding for major expansion, with the aim of the business leading to initial public offering (IPO) or acquisition

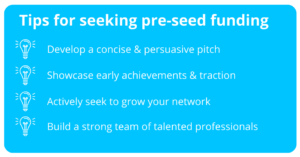

Pre-Seed Stage

Getting the funds to start

The pre-seed funding stage is the critical first step towards turning a promising idea into a thriving business. This early-stage investment provides the initial capital to validate the concept and start building a minimum viable product.

Investment from friends

Investment from friends

Investment from family

Investment from family

Funds from savings

Funds from savings

Remember!

- The capital size is usually small in the range of a few £100 to a few £1,000 from family, friends or personal savings.

At this stage the goal is to gain enough funding to validate your idea. The funding will enable you to test the market and demonstrate initial traction.

Why is it an important step?

- By being able to validate your idea and demonstrate early traction, you will help to de-risk the venture and increase the appeal of the business to investors.

- Early success at this stage, even on a small scale will help to build momentum and confidence allowing you to attract larger investors and grow the business further.

Gaining early funds and testing the product on the market creates the ability for you to tap into the islands growing ecosystem and connect with potential mentors, investors and collaborators.

Seeding Stage

Early stage investment

Seed funding for startups signifies a crucial step where a business transitions from a budding idea to a viable, revenue-generating entity. Unlike the pre-seeding stage, which focuses on concept validation, market research and minimal viable product (MVP) development.

- Actively seek funding from angel investors or government grants. This funding is vital for scaling operations, expanding the team, and refining the product.

- Shift your focus towards establishing a solid business structure, including legal incorporation, intellectual property protection and a well-defined go-to-market strategy.

- Pursue early customers and generate initial revenue streams. This provides tangible evidence of market demand and validates the business model.

- Create a sustainable business model that can be replicated and expanded to accommodate future growth.

Series A Stage

Funding to scale

Series A funding represents a significant milestone for startups. It typically involves larger investments ranging from a few million to tens of millions of pounds in order to expand the business.

Why is it an important step?

- At this stage funding will provide the ability to expand operations, hire key personnel for your team to grow the product and business model through research and development.

- The increase income of capital allows you to accelerate growth by increasing marketing efforts, expanding into new markets and scaling production.

- At this stage you will be able to thoroughly test your business model and demonstrate the viability and scalability, preparing the business for further investment and scaling.

- You will be able to refine your companies strategy and improve the operational efficiency creating strong building blocks for the business future.

High-Net-Worth Individuals

High-Net-Worth Individuals

Venture Capital

Venture Capital

Institutional Investors

Institutional Investors

Series B Stage

Seeking substantial capital

Once you have successfully navigated the seed and Series A rounds you are typically demonstrating strong traction, scaling rapidly and your next step is to seek substantial capital to fuel their expansion plans – Series B.

Focus on

How much capital you want to raise?

What terms are you happy to agree on?

What do you plan to achieve in this stage?

What is your burn rate?

When will your cash runway end?

How do you plan to achieve it?

Milestone planning

- Gain larger investment rounds compared to earlier stages, ranging from tens of millions to hundred of million pounds.

- Focus on growth expansion including market expansion and product market development.

- Start planning for strategic acquisitions and begin acquiring compatible companies or technologies to accelerate growth.

- Increase investor due diligence preparation, as larger investments will require increased scrutiny from investors.

Later Stage Funding

Once you have successfully navigated the early stages of funding, you are now ready for later-stage financing options which can provide the fuel needed for significant growth with the aim of seeking significant expansion or an IPO.

Types of later stage funding

Series C & D

Round of funding typically used for scaling operations, expanding into new markets, or funding major product development initiatives. Investors at this stage are looking for strong revenue growth, a proven business model and a clear path to profitability.

Growth Equity (for high-growth startups)

At this stage you are seeking substantial capital to fuel rapid expansion. Investors often take a minority stake in the company and provide strategic guidance alongside financial support.

Mezzanine Financing

This involves a hybrid of debt and equity, offering more flexibility than traditional debt financing. It’s often used for acquisitions, buyouts or major capital expenditures.

Preparing for later stage funding

Demonstrate strong fundamentals through a solid track record of revenue growth, customer acquisition and market share.

Have proof of a scalable business mode. Investors will want to see your business model and that it can be easily replicated and expanded.

Have a clear exit strategy! Investors will want to understand how they can realise returns on their investment. Your options for this include IPO or acquisition.

Work with experienced financial advisors to ensure you navigate the complexities at this stage! No company got big all on its own!

Be organised and have a clear path you want to take your startup. Understand how you want your decision making autonomy to run as larger investors take larger equity stake.

1) Define your funding needs

Determine the amount of funding you need and be clear on how those funds are going to help you achieve a milestone e.g. product development, marketing or hiring. Be realistic about the amount of funding you will need for the next 12-18 months.

2) Build a strong network

Connect with as many professionals as possible through attending industry and network events. Making sure to engage with the Jersey Startup ecosystem at Digital Jersey, surround yourself with the right knowledge and connections. Remember people invest in people!

3) Know your due diligence

Be prepared and make sure all your documentation for business, financing and team are up to date and are well prepared for through due diligence checks to be completed by investors.

4) Get to know the local investment landscape

Research the preferences and investment criteria of local investors. Explore the potential benefits of Jersey’s regulatory environment and access to international markets.

- Prepare a compelling pitch which highlights your business value and investment opportunities

- Leverage online platforms to showcase your business and connect with potential investors

- Network and attend industry events, from conferences, workshops attend as much as you can

- Seek professional advice from financial advisors

Jersey Funding Landscape

Government Grants

When looking for a funding route, some startups apply for funding though Government innovation schemes and funds can be provided as grants or subsidies.

Grants

“A grant is capital awarded to your business that doesn’t have to be repaid. Grants are awarded to assist your startup in it’s development.”

Seed-ready – Startup funding in the UK: A beginner’s guide

Subsidies

“A subsidy is a sum of money or tax reduction provided by the government. Subsidies are usually awarded to relieve a specific burden or to promote something in the public interest.”

Seed-ready – Startup funding in the UK: A beginner’s guide

Current Government Schemes in Jersey:

Productivity Support Scheme (PSS)

This scheme provides grants to businesses to support individual business innovation, efficiency, and productivity improvements.

Bootstrapping

What is it?

Bootstrapping or more commonly known as self-funding and is when a founder uses personal savings, previous revenue and other internal resource to finance the startup.

Why is this a good option in Jersey?

Lower Overhead Costs

Compared to larger countries, Jersey can offer lower operating costs for businesses, which can help bootstrapped companies stretch their resources further.

Strong business ecosystem

The island has a thriving business community with a supportive network of entrepreneurs, investors, and service providers.

Challenges to be prepared for

A limit of resources as without external funding you are relying solely on your revenue and savings. This will restrict marketing budgets and hiring potential.

A slow growth rate as organic growth will take time and you will need to prioritise your profitability. You will need to focus on sustainable growth instead of rapid expansion.

Be careful of your burn rate! Make sure to complete thorough financial planning and ensure every expense is considered carefully to ensure you do not run out of cash before achieving profitability.

Jersey’s relatively small population and economy might limit the initial market size for your startups leading to a slower early revenue growth.

While Jersey has a skilled workforce, attracting specialised talent in certain fields might require recruiting from outside the island, which can add costs and logistical challenges

Having to quickly validate your product-market fit and achieve customer traction to generate the revenue needed for survival and growth.

Angel Investors

Who are they?

Angel investors are high-net-worth individuals who provide financial backing to early-stage startups in exchange for equity.

They are often former entrepreneurs or successful business executives with a deep understanding of the startup ecosystem. Angel investors typically invest their own capital, rather than pooling funds from other investors.

Why are angel investors a good funding option?

Seed funding

Seed funding is gained typically from high net worth individuals because it is often difficult to obtain from traditional sources like banks. This early-stage funding allows startups to develop their products, hire talent, and validate their business models.

Mentorship

Beyond capital, angel investors offer invaluable mentorship and guidance. Their experience and industry connections can be instrumental in helping startups navigate the challenges of early-stage growth.

Validation & Credibility

Validation and Credibility: Securing investment from a reputable angel investor can lend credibility to a startup, making it more attractive to potential customers, partners, and future investors.

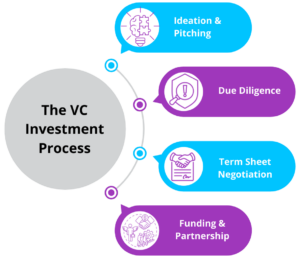

Venture Capital

Venture capital (VC) is a type of private equity financing provided by investors to startups and small businesses that are believed to have long-term growth potential. Venture capital firms invest in exchange for equity stakes in the companies they fund.

Benefits of VC funding?

- VC firms provide significant capital to fuel rapid growth and expansion.

- VCs often bring industry knowledge and connections to help startups succeed.

- Securing VC funding can be a strong signal of a startup’s potential to investors and customers.

Finding the right VC for you?

- Attend industry events, connect with other entrepreneurs, and leverage online platforms to find potential investors.

- Identify VC firms that specialise in your industry and have a track record of successful investments.

- Prepare a concise and persuasive pitch to showcase your startup’s unique value proposition.

Bank Loans

Most startups seek bank loans for funding, but this can be challenging due to their limited revenue and assets, especially for those starting on the island.

NOTE – Traditionally, banks would require audited financial statements, which can increase business costs and impose specific loan covenants to ensure that the business meets its repayment targets.

Understanding the landscape:

Traditional Banks

While traditional banks may be hesitant to lend to early-stage startups, they can offer competitive interest rates and flexible repayment terms for established businesses with a strong track record.

Alternative Lenders

These non-bank lenders specialise in lending to startups and small businesses. They often have less stringent requirements and faster approval processes, but typically charge higher interest rates.

Develop a compelling pitch

Step 1

Be clear on what your value proposition is! Make sure to articulate your unique selling proposition and how your product/service solves a real problem

Step 2

Demonstrate a thorough understanding of your target market, competition and market size

Step 3

Outline your sales and marketing plans, including customer acquisition and retention strategies

Step 4

Present realistic and well-supported financial forecasts (revenue, expenses, profitability)

Step 5

Highlight the skills and experience of your founding team.

Do’s For Securing Funding

Don’ts

Good Luck!

Securing funding can be a challenging but rewarding process for startups. By carefully considering your funding needs, developing a strong business plan and leveraging the available resources, you will increase your chances of success. Make sure to check out our templates for further guidance!

Note -This guide is for informational purposes only and should not be construed as financial or legal advice. It is essential to consult with qualified professionals before making any investment decisions