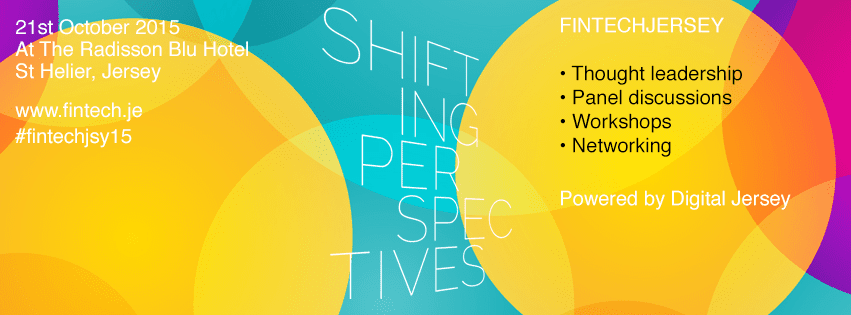

Ahead of running the Channel Island’s first (and now sold out) Fintech Jersey conference in October, I thought it was worth reflecting on the island’s progress thus far.

2015 is shaping up to be a pivotal year for Jersey’s fintech sector. We have attracted a growing number of new businesses to the island and local fintech business exports have continued to grow. Jersey’s success has been based on a combination of experience, innovation and proactively embracing new ideas. The sector is now generating its own activity, this is driven partly by Digital Jersey and autonomously by industry, with events like KPMG’s Fintech Friday. In addition we are experiencing clusters of activity, which are reaching out to a the wider global fintech community.

Jersey as a Global Fintech Hub

Our independence, agility and legal environment has enabled us to charter our own course in building a world class reputation for the delivery of financial services, this combination has resulted in a well established and highly regarded financial sector. Our journey into the global fintech market was a natural development, leveraging our existing strengths and combining them with advanced technology and intellectual property. Our world-renowned finance sector is a natural partner for the technical community, both can take advantage of the opportunities (and challenges) presented by the fintech revolution. The result of this collaboration is evident in the island’s early clusters of fintech specific activity.

Support and Funding

Being an island, Jersey’s size gives us a key advantage, fostering close working relationships. Digital Jersey bridges the relationship between government, the regulator and industry representatives, forming a fintech ‘steering group’ to ensure that there is continued ongoing dialogue. Combined with the Jersey Financial Services Commission (JFSC), we are able build on innovation and implement new legislation at pace. Government recently commissioned a report on innovation and it is in the process of implementing the recommendations in order to further stimulate the sector.

Funding is a key consideration for any business, particularly for start ups and small businesses. There are a number of funding options, from both the public and private sectors, many local and international fintech businesses have successfully gained funding through Jersey. The Government set up the Jersey Innovation Fund, (JIF) allocating £5million as an investment pool to accelerate innovative businesses and support entrepreneurs. JIF continues to seek requests for funding support.

What’s happening in the Jersey Fintech Scene?

There is a diverse cross-section of fintech business currently operating in Jersey, spanning banking, KYC, payments, insurance, portfolio management and market analytics, cryptocurrency and blockchain technology.

Establishing the New Finance Jersey chapter has been another development. This facilitates a global fintech reach, linking us to digital hubs in London, Hong Kong and New York. The Jersey chapter holds meetings to showcase local talent and discuss emerging trends surrounding fintech.

The Future

The island wants to attract innovation and grow its digital skills base, both through importing talent and business, and encouraging home-grown innovation and skills development. We will continue the on-going engagement between industry, Digital Jersey, the regulator and government to ensure that the island responds with speed and agility to market trends.

In terms of disruptive fintech business, which is innovation that will eventually replace existing business, peer-to-peer lending is already well established and a growing number of Jersey financial service businesses are investigating the implications of machine learning and artificial intelligence for their business. Those willing to embrace this technology, particularly when combined with new regulation, are able to accelerate beyond their competitors. Ultimately, the finance sector has to embrace fintech and take advantage of the latest innovations to provide a better customer experience and maximise returns.

Innovation will also bring new skills and access to new global markets, which will benefit the island as a whole. We anticipate a growth and shift of our existing finance sector towards further adoption of fintech solutions, with a parallel development in complementary and disruptive technologies to ensure the Jersey’s offering is multifaceted.

I look forward to the upcoming Fintech Jersey 2015 conference, which will also spur new ideas and build new relationships, as well as offering Jersey key insights into what the global market is doing and what we need to do to stay ahead of the curve.