Popular

If you are thinking of starting a digital business, take 10 minutes to discover your best path to find helpful resources and guides using our Startup Toolkit Explorer to get your on your way!

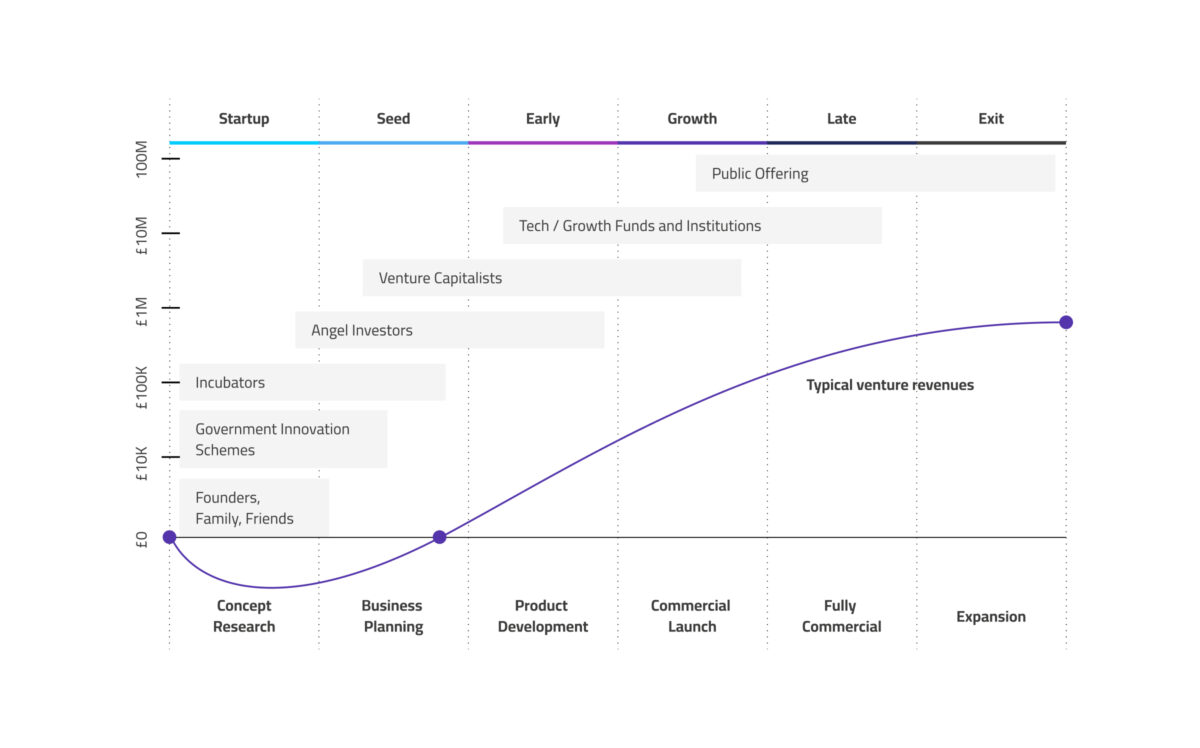

It is common for founders to ‘bootstrap’ (self-fund) their business in the early days. Sometimes, founders will also ask friends and family if they would like to invest their money, for a small percentage of equity. If you can self-fund 100% of the business, you will own 100% of shares which is an enviable position, especially for when you exit the company. At all stages, it’s important to know how much capital you need and what you will use if for.

In some cases, start-ups can apply for funding through Government Innovation schemes. Capital can be awarded as grants or subsidies. As explained by Seedready: ‘A grant is capital awarded to your business that doesn’t have to be repaid. Grants are awarded to assist your startup in its development. A subsidy is a sum of money or tax reduction provided by the government. Subsidies are usually awarded to relieve a specific burden or to promote something in the public interest. Both grants and subsidies are usually awarded for a predetermined industry or business sector.

Incubators (such as Digital Jersey) provide support to start-ups through low cost working spaces, mentoring programmes, networking events and support with access to funding.

In Jersey, we are fortunate to have an established community of Angel Investors. Angel investors are typically high net worth individuals who will provide funding for a start-up, usually in exchange for equity. At this stage of raising funds, an alternative to Angel Investors is crowdfunding through platforms such as Seedrs and Crowdcube. Crowdfunding is when capital is raised through a large number of people.

Venture Capitalists are financial institutions that invest in those early stage businesses which are typically completing the seed stage by having proven there is market need and they can scale up. Early stage funding tends to come in tranches, starting with Series A, then Series B and so on. Venture Capital firms invest in a company in exchange for a percentage of the equity.

There are a number of Venture Capital firms which are hosted in Jersey for administrative reasons, although their investment managers tend to be located outside of the island.

As early stage businesses continue to grow and progress through Series B and C funding stages they may also be attractive to a wider range of Growth Funds and other institutions such as Private Equity. Typically Growth Funds are Venture Capitalists with a particular focus or segment and will be looking for businesses which have proven market traction, predictable revenues and solid avenues for growth. Investment will again be on the basis of an exchange for equity and it is common for the equity shares to be split into different classes at this stage. Private Equity institutions may also invest at this stage, although they tend to look for more mature businesses and often seek a higher equity stake.

An IPO (initial public offering) is when an unlisted (private) company is ready to raise funds by selling shares to the public. This is done by listing the company on a stock exchange such as the London Stock Exchange or New York Stock Exchange. Companies like Amazon and Apple are listed on the Nasdaq (also based in New York city). An IPO is considered a huge milestone and symbol of success for entrepreneurs.